INDEX

Marubeni REIT Advisers Co., Ltd. (MRA), an asset manager of United Urban, positions thorough compliance as a basic principle of management and sorts out the following compliance system.

United Urban is committed to legal compliance and appreciation for social norms as one of the basic principles and operates a compliance system with an emphasis of preventing conflicts of interest. Also, an outside attorney and a certified public accountant are appointed as supervisory officers of United Urban to supervise the performance of duties of the executive officer.

United Urban operates an internal management system through the Board of Directors. In the Rules of the Board of Directors of United Urban, it is stated that the Board of Directors shall convene at least once every three months. The executive officer and supervisory officers must attend the Board of Directors meeting, with the participation of MRA. And the executive officer is required to report on the performance of duties of MRA, the administrative agent and the asset custodian.

Furthermore, while the Rules of the Board of Directors states that reports on the performance of duties shall be presented at least once every three months, in practice the reports are presented monthly.

MRA understands that incomplete compliance results in loss of trust of investors in the financial market and impair the management base of United Urban and MRA. Therefore, MRA sets thorough compliance as a basic principle of management. With the Board Meeting at the top, President and CEO, the Compliance Committee and Chief Compliance Officer (CCO) make various decisions regarding compliance as well as manage compliance with their rights and responsibilities.

Placing compliance as a matter of utmost importance, MRA established the Compliance Regulations that stipulate basic matters on the compliance system and management, the Compliance Manual, a handbook for employees including contract workers for implementing compliance activities, and the Compliance Program, a specific execution plan for each fiscal year. Each of these are reviewed by the Compliance Committee and resolved by the Board Meeting.

MRA understands compliance as the adherence by our officers and employees to laws, regulations and the internal rules (“laws, etc.”) and the implementation of sincere and fair corporate activities in a way that does not violate social norms.

The followings are specified as our basic policies in the Compliance Regulations.

The Compliance Committee aims to promote thorough compliance of MRA in collaboration with the Board Meeting and the auditors.

The Compliance Committee avoids transactions involving conflicts of interest by reviewing transactions between United Urban and related interested parties, etc. from the perspective of abiding by laws, etc. and various procedures as well as securing compliance.

The Compliance Committee is currently comprised of four members, namely CCO (chairperson), President and CEO, the head of the General Affairs Department and one external attorney. The committee meets once a month in principle to deliberate whether or not there are any acts in MRA’s management of United Urban’s assets and other operations which are problematic from the perspective of compliance and how they are handled, mainly pertaining to A through C below. It is reported to the Board Meeting when necessary.

The Compliance Committee examines all of the reviews conducted by the Investment Committee on investment and asset management that United Urban involves from the perspective of compliance. If the examination shows that there is a compliance problem, the Compliance Committee promptly reports the examination results to the Board Meeting.

The Compliance Committee convenes once a month in principle and deliberates whether or not there are any controversial acts in MRA’s management of United Urban’s assets and other operations from the perspective of compliance and also considers measures if there is a problem. In case that there is an act which is or may be problematic in light of laws, etc., the Compliance Committee reports to the Board Meeting.

MRA, the asset management company of United Urban, established the Internal Audit Regulations. Under a system which places CCO as the head of internal audit, three types of audits are conducted; 1) regular audits in which overall internal management of subject departments is examined and evaluated; 2) follow-up audits which review the improvement status based on the results of the regular audits; 3) special audits which are implemented for specific matters that CCO deems necessary or by special order of the President and CEO of MRA.

Regular audits review the entire operations of MRA and examine items common to all departments and items specific to individual departments. For items specific to individual departments, the compliance, effectiveness, efficiency, conformity, etc. of operations and internal control are inspected. Then, departments to be audited are selected based on the status of risks in light of the “control points table,” “risk management status list,” etc. The regular audits are implemented along a formulated audit plan for individual items are implemented after passing deliberation by the Compliance Committee and obtaining approval of the Board Meeting.

CCO exchanges views with the audited departments on the findings of internal audits, points of concern, advice, suggestions for improvement and measures to be taken, etc. Then CCO compiles the audit results and reports to MRA’s President and CEO as well as the MRA’s Board Meeting after the deliberation by the MRA’s Compliance Committee.

Number of Departments Targeted by Regular Audits

| Fiscal 2017 | Fiscal 2018 | Fiscal 2019 | Fiscal 2020 | Fiscal 2021 | Fiscal 2022 |

|---|---|---|---|---|---|

| Audited departments: 8 Total departments: 13 |

Audited departments: 8 Total departments: 13 |

Audited departments: 6 Total departments: 13 |

Audited departments: 4 Total departments: 13 |

Audited departments: 5 Total departments: 13 |

Audited departments: 0 Total departments: 13 |

MRA abides by a set of regulations stipulated by the Investment Trust Act and sets internal rules on transactions between United Urban and the sponsor group and other conflicts of interest and operates a system of investigation across organization.

For the purpose of preventing damage to United Urban’s interests in transactions between United Urban and the sponsor group, MRA formulates the Investment Committee Rules on Transactions with the sponsor group as internal rules for avoiding conflicts of interest. The Investment Committee Rules on Transactions with the sponsor group prohibits unnecessary transactions with the sponsor group that harm the interest of United Urban. Also, in the case of transactions with the sponsor group including acquisition or disposal of real estate, etc., approval from the Investment Committee and examination by the Compliance Committee are required. And if it is deemed that there is or may be a compliance problem, the approval of the Board Meeting is required to proceed. In the process of approval, strict measures to prevent transactions with a conflict of interest are set. More specifically, external professionals are to participate in the Investment Committee and the Compliance Committee, and committee members who have a conflict of interest are to be excluded from the process.

As a part of the Marubeni Group, MRA, the asset management company of United Urban, prioritizes compliance above all else and recognizes that any business which cannot be undertaken without engaging in improper conduct is unnecessary and contrary to the company’s interests.

As an international corporation, the Marubeni Group prohibits bribery and related conduct, has stipulated standards of behavior to be followed, and works diligently to prevent bribery. For the purpose of consistent implementation of anti-corruption practices by all officers and employees of the Marubeni Group worldwide, Marubeni has formulated the Anti-Corruption Handbook to be followed by all of their officers and employees. Furthermore, to ensure thorough bribery risk management, MRA distributes the Marubeni Group Anti-Corruption Policy to our business partners and relies on their collaboration in performing anti-corruption due diligence.

The Marubeni Group Anti-Corruption Policy stipulates the following measures to ensure the implementation of the policy, and as a member of the Marubeni Group, MRA also applies these.

Moreover, MRA has formulated an internal audit plan based on the Internal Audit Regulations and strives to rapidly identify risks, etc. that are inherent to our business as an investment manager, including risks of legal violations and improper transactions, and actively prevent violations of the law, etc. through spot audits and risk-based audits of individual items. The status of the internal audit plan’s formulation and the results of internal audits are reported without delay to our Board Meeting and improvement plans and other measures are implemented in response to risks relating to improper transactions.

As a member of the Marubeni Group, MRA follows the group’s compliance system. The Marubeni Group stipulated the Marubeni Corporate Principles, Compliance Manual as well as a code of conduct for the entire group so that the officers and employees will conduct corporate activities in a compliant manner.

Compliance for the Marubeni Group is the observance of laws, regulations and internal corporate rules in line with the spirit of “Fairness, Innovation and Harmony” expressed in the Company Creed, the Marubeni Corporate Principles and the management philosophy, as well as the observance of a corporate ethical code and the conducting of corporate activities with a high moral perspective.

“Fairness” in the Company Creed of Marubeni Group means being fair and decent. “When you are faced with a choice between integrity and profit, choose integrity without hesitation.” Guided by the wisdom in this aphorism, the Marubeni Group sets the Compliance Manual which includes a standard of conduct that all officers and employees of the group must comply with in executing their daily operations.

Fairness To be fair and decent.

Innovation To be active and innovative.

Harmony To respect each other and cooperate.

As a member of the Marubeni Group, MRA has all of our employees (including contract employees) take the Marubeni Group’s compliance training to foster their understanding of the Marubeni Group’s corporate ethics and anti-bribery policy at least once a year under the command of MRA’s President and CEO who is referred to by the chairman of Marubeni’s Compliance Committee.

After the training, all employees (including contract employees) take an oath to MRA’s President and CEO, stating that they observe the Marubeni Group’s Compliance Manual and Anti-Bribery Policy.

Furthermore, all employees (including contract workers) of MRA join trainings by external institutions and lectures with expertise every year in the areas of comprehensive supervisory guidelines for financial instruments business operators, prevention of transactions involving conflicts of interest, customer-oriented operational management, prevention of insider trading, etc.

For a sound management of operations, MRA sets the Rules for Handling Misconduct, Clerical Errors, etc. It stipulates a uniform standard for processing misconduct by officers and employees, acts which violate or may violate laws, etc. (including the rules of the Investment Trusts Association, Japan, rules of the financial instruments exchange on which United Urban’s investment units are listed, the Articles of Incorporation of United Urban, the internal rules, etc.), clerical errors, complaints and other matters that may lead to management risks and reputational risks for MRA and United Urban.

CCO reports misconduct, clerical errors, etc. to the Compliance Committee and the Board Meeting when necessary. CCO compiles incidents of misconduct, clerical errors, etc. to present periodic reports to the Compliance Committee at least once a year. Also, CCO manages the process from reception of an incident report to its resolution, periodically monitors the implementation of preventative measures and reports the status to the Compliance Committee and, when necessary, MRA’s President and CEO.

MRA complies with the Board Meeting’s stipulation on corporate activities that donations and contributions relating to political activities must not be made to political parties or political fundraising organizations.

Amount of Political Contributions/Recipients of Contributions

MRA has not made any political contributions.

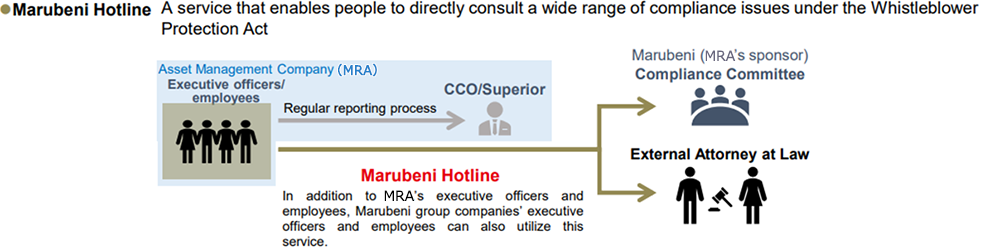

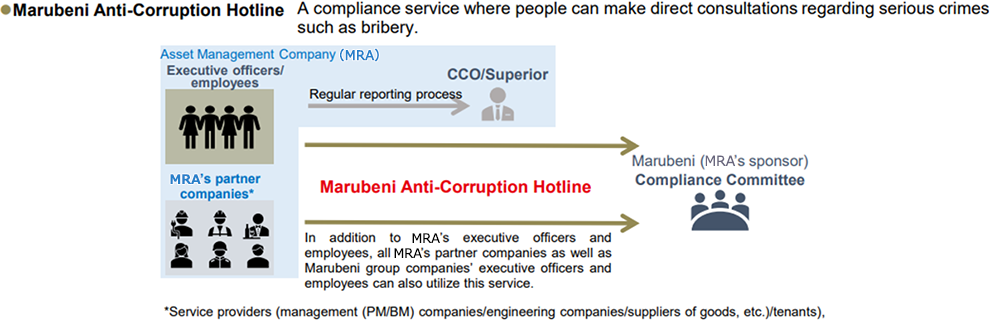

MRA has multiple points of contact which are available for all of our employees and our partner companies. Those include 1) the internal consultation system, 2) the consultation system managed by an external company, 3) Marubeni Hotline and 4) Marubeni Anti-Corruption Hotline managed by Marubeni Corporation. Each system provides comprehensive whistleblowing/consultation to prevent corruption and bribery as well as organized crime including money laundering and terrorism, etc., and to impede violations of the law or internal regulations. They also handle work- or workplace-related troubles or inquires, including power harassment and sexual harassment. The contact information for each consultation system is widely circulated by publishing it on the company intranet and posting it in the office.

The consultation systems may be used 24 hours a day for purposes of whistleblowing or consultation by officers, employees, and temporary workers (including individuals who left the company within the past year) of MRA or our business partners via the method of their choice, including phone, email, online form, mail, in person, etc. Based on their specific characteristics, some systems may limit the consultation methods or the individuals who may use them. These systems may be used anonymously if so desired.

The representatives contacted via a consulting system will ask detailed questions about the case brought to their attention, and the person responsible for investigating will investigate the situation unless there is a valid reason not to do so, such as cases where the matter has already been resolved. Based on the investigation results, corrective actions will be implemented if required, and steps will be taken to verify that the corrective actions work appropriately. Moreover, based on the investigation’s results, if conduct that violates the law or the like is discovered, appropriate measures will be taken to remedy the situation and prevent recurrence, such as stipulating disciplinary sanctions in the internal regulations based on the rules of employment.

MRA also implements comprehensive protection of whistleblowers’ privacy and does not tolerate any detrimental treatment of whistleblowers. The internal regulations stipulate rules that strictly control access to information about consultation matters, including the whistleblower’s name, and state that officers or employees who treat whistleblowers or individuals who cooperated in an investigation (“whistleblowers, etc.”) unfavorably, as well as officers or employees who perform actions intended to identify whistleblowers, etc., will be subject to strict measures, including disciplinary sanctions.

Furthermore, it is also possible to use the consultation systems for inquiries relating to the mechanisms for handling whistleblowing and protecting whistleblowers, etc. and inquiries relating to detrimental treatment experienced following a consultation.

To increase officers’ and employees’ expectation that actions violating the law, etc. can be remedied through whistleblowing and consulting, MRA discloses the results of handling matters reported such as the number of consultations using a whistleblowing system to all officers and employees while taking sufficient care to protect personal information, etc.

As a preventive measure for problems raised using whistleblowing systems, MRA management-level employees are appointed as Compliance Officers who oversee the inspection, coordination, and thorough implementation of compliance items relating to matters under the jurisdiction of each department. In addition to promoting compliance in each department, the Compliance Officers share information about examples of legal violations or paperwork-related errors that occur in each department.

MRA has also formulated the Compliance Manual comprising the basic details of the laws to be followed and the compliance activities to be taken. To promote understanding of the Compliance Manual, MRA creates a compliance program once per fiscal year as a rule, which serves as a specific implementation plan for achieving compliance and will be revised if necessary. In addition, education activities for officers and employees are conducted about MRA’s business environment, the laws to be observed, preventive measures and actions taken if a violation of the law occurs.

Internal regulations set out what behavior corresponds to power harassment or sexual harassment, the company’s stance that power harassment and sexual harassment are issues that should be eradicated and how cases are handled if harassment does occur (e.g. consideration of privacy). They are posted on the company’s intranet so that MRA’s officers and employees may consult them at any time.