Among the goals, the target to "Reduce entire portfolio’s total GHG emissions covering Scope 1+ 2 by 42% by 2030 (compared to 2021)" has received SBTi certification. This is based on scientific evidence aimed at aligning with the Paris Agreement, which aims to hold the increase in the global average temperature well below 2°C above pre-industrial levels and strives to limit the temperature increase to 1.5°C above pre-industrial levels.

In the process to set our new targets, i.e., “Reduce total GHG emissions covering our value chain (including Scope 3) to net zero by 2050”, United Urban conducted a scenario analysis by using CRREM. a tool for assessing and monitoring the transition risks.

The pathway results show our efforts for energy saving (investment in highly efficient equipment and improvement in operation) and renewable energy introduction will be on the line of 1.5°C scenario by the late 2030s. However, from the late 2030s and onward, we recognize the risks of exceeding the 1.5°C pathway.

United Urban steadily promotes measures for energy saving and renewable energy for the time being and examines measure to further reduce GHG emissions with an eye on social, economic, and technological trends.

As an owner of large-scale business facilities whose greenhouse effect gas emissions are assumed to be high, United Urban sets a target to reduce the “specific energy consumption rate” by 1% per annum on average for 5 years (“Specific energy consumption rate” is calculated by the factors like energy consumption, floor space, etc.). Untied Urban makes efforts to accomplish the target by such means as introducing highly-efficient equipment suitable to each facility on replacement of air-conditioners or lighting equipment.

In recent years, environmental issues, including climate change, have been growing more severe globally. In Japan, large-scale natural disasters have been occurring more frequently due to extreme weather, which has had a major impact on economic and social activity. The Paris Agreement was adopted at the 2015 United Nations Climate Change Conference (COP) to address climate change at the global level through the coordinated efforts of international society. Under the framework of the Paris Agreement, there is an increased expectation and need for the private sector to play a role in reducing GHG emissions.

MRA believes that addressing climate change is critical in the management of United Urban’s portfolio. We fully recognize the risks and opportunities associated with climate change and continue to pursue initiatives to solve the issue through real estate investment and management in order to realize a sustainable society for all stakeholders.

Based on our current recognition of climate change, MRA and United Urban have revamped the Environmental Policy established in 2012 and formulated the Sustainability Policy in 2022. Created as guidelines for implementing initiatives to resolve environmental, social, and economic issues and create new value, the Sustainability Policy incorporates approaches to tackling climate change, reducing our environmental footprint, realizing a recycling-based society and sustainable cities, contributing to local communities, and respecting human rights, as well as cooperation and collaboration with stakeholders and enhancement of productivity and job satisfaction of executives and employees.

To address climate change, it is stated in the policy that we will strive to reduce greenhouse gas emissions by actively promoting efficient use of natural resources and energy from the perspective of sustainability and resource efficiency as well as realize a decarbonized society by introducing environmentally friendly technologies and systems.

Recognizing the importance of climate-related financial information disclosure, MRA announced our endorsement of the TCFD’s recommendations in January 2022.

Moreover, MRA formed a cross-organizational team of members representing various departments, which conducted a scenario analysis of climate risks and opportunities for United Urban’s portfolio in accordance with the TCFD’s recommendations.

MRA’s climate-related information disclosure, based on the TCFD’s framework, is shown below.

Disclosure Items Recommended by the TCFD

| Item | Summary |

|---|---|

| Governance | The organization’s governance around climate-related risks and opportunities |

| Strategy | The footprint and potential impacts of climate-related risks and opportunities on the organization’s business, strategy and financial planning (scenario analysis) |

| Risk management | Processes for identifying, assessing and managing climate-related risks |

| Metrics and targets | Metrics and targets for assessing and managing climate-related risks and opportunities |

For the purpose of carrying out sustainability activities, including measures to tackle climate change, MRA has formulated the Sustainability Regulations. Through the system based on these regulations, we implement sustainability activities in a strategic and organized manner.

| Body | Overview |

|---|---|

| Board Meeting | Formulate and revise the Sustainability Policy and supervise sustainability activities |

| Chief Sustainability Officer |

|

| Chief Sustainability Operation Officer |

|

| Sustainability Committee |

|

In accordance with the Sustainability Regulations, the Board Meeting also receives reports from the Chief Sustainability Operation Officer on materiality at least once a year and performance of sustainability activities more than four times a year and conducts a continued monitoring based on those reporting.

The Sustainability Committee was established in 2013 with the aim of resolving ESG issues through a cross-organizational approach. Since a responsive decision-making is a priority, the committee members include MRA’s management team (President and CEO, CIO, CFO).

The Sustainability Committee mainly discusses and reports on the following items:

Moreover, the system enables committees and sub-committees relating to sustainability activities to be formed based on the decision of the Chief Sustainability Operation Officer. These committees can discuss and report on necessary matters and plan and implement measures. With the aim of reducing energy consumption at properties owned by United Urban, the Energy-Saving Committee and Energy-Saving Sub-Committee have been set up as task forces within MRA and work to streamline energy use.

With the intention to enhance ESG awareness at MRA and accelerate more practical efforts to address ESG issues at United Urban, the heads of all departments at MRA serve as members of the Sustainability Committee. Also, we formed a cross-departmental ESG team consisting of each member from the four asset management departments assigned as ESG officers, and strengthen the internal system at the working level.

With regard to the impact of future climate change on the company’s real estate asset management business, looking ahead to 2050, MRA conducted a scenario analysis in accordance with the TCFD’s recommendations. In the scenario analysis, we discussed how we should respond to changes in the external environment as well as business risks and opportunities in 2030.

The TCFD’s recommendations suggest consideration based on multiple warming scenarios. MRA assessed the impact of climate-related risks and opportunities for the current scenario (3-4°C scenario) and transition scenario (1.5°C scenario).

An overview of the respective scenarios, including the global outlook in each case, is shown below.

| Current Scenario (3-4°C Scenario) | Transition Scenario (1.5°C Scenario) | |

|---|---|---|

| Overview | Foresees a world in which reduction efforts of carbon emission do not exceed the current level and the average temperature rises by a maximum of 3°C to 4°C at the end of 21st century | Foresees a world in which decarbonization efforts advance in order to keep the rise in the average temperature at 1.5°C at the end of 21st century |

| Global outlook in scenario |

|

|

| Main reference scenarios |

|

|

The scenario analysis mainly covers ownership and management of assets that United Urban entrusts to MRA for management. We conducted the scenario analysis while also bearing in mind the impact during property acquisition/disposal and on financing.

The TCFD’s recommendations divide climate-related risks into two categories: physical risks and transition risks. In the scenario analysis, we identified physical risks in the current scenario and transition risks in the transition scenario, then specified the key risks that are presumed to have a strong correlation with our business.

In information disclosure recommended by the TCFD framework, climate-related risks are typically organized as shown below.

Risk Categories

| Climate-related risks | Physical risks | Acute risks |

|---|---|---|

| Chronic risks | ||

| Transition risks | Policy/legal risks | |

| Technology risks | ||

| Market risks | ||

| Reputation risks |

Climate-Related Risks

| Physical risks | Risks associated with global warming and climate change |

|---|---|

| Transactions risks | Legal, technological and market risks pertain to low-carbon economy |

Physical Risks

| Acute risks | Direct and indirect risks due to growing severity of extreme weather and natural disasters |

|---|---|

| Chronic risks | Risks due to long-term changes such as increased average temperature, rising sea level, and changing weather and rainfall patterns |

Transition Risks

| Policy and legal risks | Risks related to promoting measures to mitigate and adapt to the causes of climate change’s adverse impacts |

|---|---|

| Technology risks | Risks associated with R&D and technology introduction for energy efficiency and low-carbon economy |

| Market risks | Risks derived from changing supply and demand for products and services |

| Reputation risks | Risks regarding reputation of the transition to a low-carbon economy |

Assumed that greenhouse gas emission reduction measures, legal restrictions, and so forth will be kept as the present level, the current scenario (4°C scenario) proposes that increased frequency and severity of natural disasters and rising average temperatures will be the major climate-related risks.

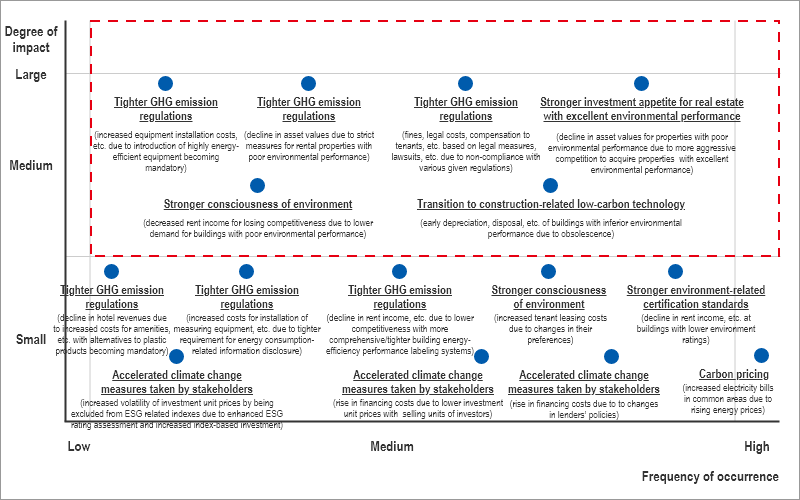

In the transition scenario (1.5°C scenario), it is assumed that greenhouse gas emission restrictions will be tightened, and real estate owners will be required to improve environmental performance beyond the current level. Other climate-related risk will include a relative decrease in demand for buildings with poor environmental performance as people’s behavior becomes more environmentally conscious.

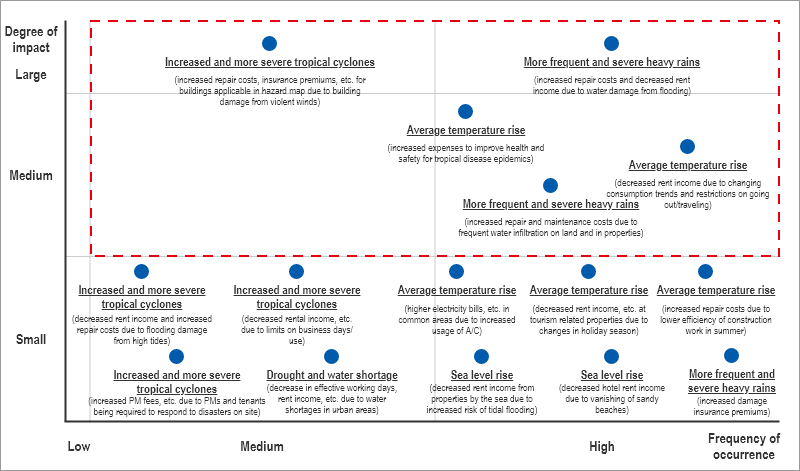

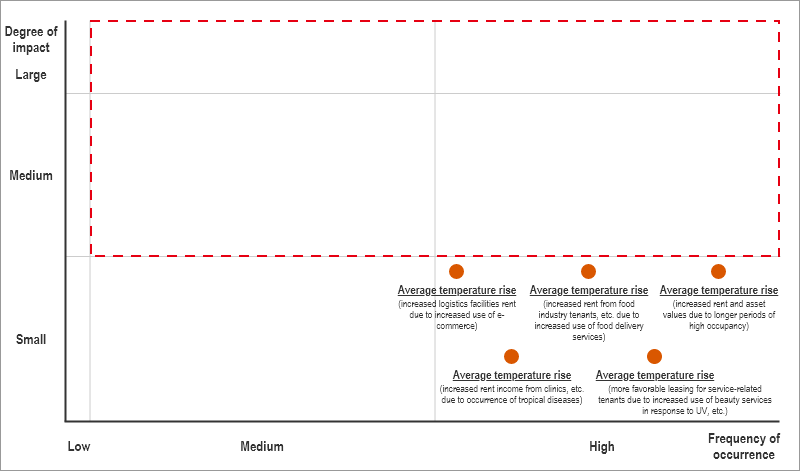

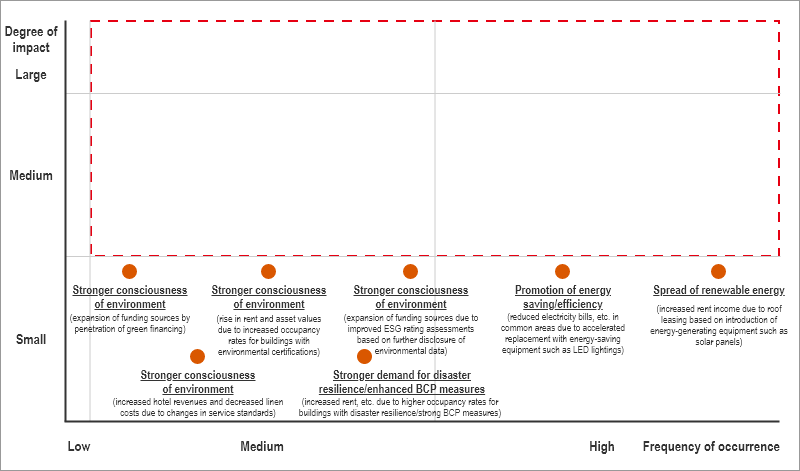

For each scenario, the financial impact of climate-related risks and opportunities on our business were identified, and for each risk and opportunity, the degree of importance were assessed based on the frequency of occurrence of the phenomena that could develop risks and opportunities and the degree of impact on the presumed costs to our business.

Current Scenario: Risks

Current Scenario: Opportunities

Transition Scenario: Risks

Transition Scenario: Opportunities

Based on the importance assessment results, the risks and opportunities regarded as highly important for each scenario were extracted and the items that have a significant impact on our business were determined.

Current Scenario

| Risks / Opportunities | Type | Climate-Related Phenomena | Time Horizon | Impact on Business | Main Financial Impacts | Importance |

|---|---|---|---|---|---|---|

| Risk | Chronic | Rise in average temperature | Medium to long term | Changes in consumption trends and restrictions on going out/traveling |

|

Medium |

| Tropical disease epidemics |

|

Medium | ||||

| Acute | More frequent and severe heavy rains | Short to long term | Building damage from flooding |

|

High | |

| More frequent water infiltration on land and in properties |

|

Medium | ||||

| Increased and more severe tropical cyclones | Short to long term | Building damage from violent winds |

|

High |

Summary

Transition Scenario

| Risks / Opportunities | Type | Climate-Related Phenomena | Time Horizon | Impact on Business | Main Financial Impacts | Importance |

|---|---|---|---|---|---|---|

| Risks | Policy | Tighter GHG emission regulations (energy-saving measures and environmental policies for building owners) | Medium to long term | Installation of highly energy-efficient equipment becoming mandatory |

|

Medium |

| Strict measures for rental properties with poor environmental performance including leasing prohibition |

|

Medium | ||||

| Legal measures, lawsuits, etc. due to non-compliance with various regulations |

|

Medium | ||||

| Technology | Transition to low-carbon technology in construction work | Medium to long term | Obsolescence of buildings with inferior environmental performance |

|

Medium | |

| Market / reputation | Stronger consciousness of environment | Medium to long term | Lower demand for buildings with poor environmental performance |

|

Medium | |

| Increased investment appetite for real estate with excellent environmental performance | Medium to long term | Fiercer competition to acquire properties with excellent environmental performance |

|

Medium |

Summary

Based on the scenario analysis, the countermeasures to reduce risks we assessed to be highly important to our business at present are as follows.

Current Scenario

| Climate-Related Phenomena and Presumed Risks | Countermeasures Considered at Present Time (Proposed) | |

|---|---|---|

| More frequent and severe heavy rains |

|

|

|

||

| Rise in average temperature |

|

|

|

|

|

| Increased and more severe tropical cyclones |

|

|

In the current scenario, it is assumed that climate disasters cause physical damage to assets and as a result an increase in maintenance and repair costs and damage insurance premiums is likely. And such climate disaster risks will also give an impact to tenants’ preferences. When disasters occur, it is possible that tenants will become highly conscious of such physical risks and avoid potential areas and buildings which will be affected. On the other hand, properties that are adequately prepared against climatic disaster risks will be viewed favorably by tenants and may be expected to have stable occupancy in the long term. Based on these ideas, MRA implements comprehensive disaster countermeasures at United Urban’s properties to reduce physical risks and enables opportunities for more stable revenues.

Transition Scenario

| Climate-Related Phenomena and Presumed Risks | Countermeasures Considered at Present Time (Proposed) | |

|---|---|---|

| Tighter GHG emission regulations |

|

|

|

|

|

|

|

|

| Transition to construction-related low-carbon technology |

|

|

| People’s behavior becoming more environmentally conscious |

|

|

| Stronger investment appetite for real estate with excellent environmental performance |

|

|

While the Japanese government sets legal restrictions relating to energy efficiency and carbon emissions of buildings, no notable regulatory compliance costs have been incurred at properties of United Urban as of today. However, in case that the government introduces carbon taxes and tightens the regulations with the aim of achieving the Paris Agreement’s targets, it is possible that energy costs will increase and the cost burden of installing equipment to comply with regulations will increase going forward.

Furthermore, as the transition to a low-carbon/carbon-neutral society moves forward, greater consideration will be given to the environmental performance of assets of United Urban by tenants, investors and society. And it is possible that the profitability of our properties and financing conditions will be impacted as a result. At the present time, there are third parties’ survey findings showing that a rent premium exists for properties with environmental certification, and financing methods such as green bonds and green loans are becoming more widespread. Besides this green premium, there is also a risk that brown discount may occur for real estate with inferior environmental performance.

MRA implements initiatives aimed at managing the environmental footprint (energy consumption, etc.) and increasing efficiency at the United Urban’s portfolio as well as making the portfolio greener by obtaining environmental certifications in order to reduce the financial impact due to regulatory changes and meet the perception of tenants and investors who are very conscious of ESG. In particular, we recognize that reducing the environmental footprint is one of the business opportunities that will bring direct financial benefits, such as lowering building management costs.

In our internal risk management regulations, which stipulate holistic risk management policy of the asset management company, MRA sets our basic risk management approach, which specifies risk management as a key management issue. From the perspective of performing asset management tasks, the risks to be managed are categorized as follows:

Specific risks are defined by further categorizing the risks above in accordance with the detailed risk management rules. In addition, these rules stipulate the periodical review of risks inherent in business processes in order to monitor and recognize risks and risk control activities.

Monitoring and recognizing risks and risk control activities are performed by using a risk control matrix as follows:

The internal auditing department is obliged to verify the appropriateness and effectiveness of risk management on a regular basis in accordance with the risk management regulations and report to the President and CEO of MRA and the Board Meeting.

United Urban and MRA have identified "Energy consumption and management, utilization of renewable energy" as materiality issues, and have set medium- to long-term action goals following the Paris Agreement. These goals are: "(1) Reduce total portfolio Scope 1 and Scope 2 GHG emissions by 42% by 2030 (compared to 2021)(ii) By 2050, Reduce total GHG emissions including value chain (Scope 3) to net zero."

In parallel with this, we have established sustainability targets and are striving to achieve the "five-year average reduction of 1% or more per unit" of energy consumption per unit, which is calculated by taking into account the amount of energy used in the properties we own and the total floor space, etc., and is an effort target required by the government under the Energy Conservation Law (Law Concerning the Rational Use of Energy, etc.).

In order to reduce greenhouse gases in a practical manner, we continue to incorporate a green lease clause to a lease contract with tenants and replace with renewable energy based on the characteristics of given properties. Also, we implement appropriate measures based on circumstances of each property including consulting with energy experts on energy saving, increasing efficiency through upgrades to air-conditioning systems and converting to LED lighting.

One of the metrics to manage climate-related risks and opportunities is the environment certification coverage rate for the portfolio of United Urban. We set a medium-term target of an 80% rate (based on gross floor area) by 2024. As a result of acquiring new environmental certifications and continued efforts to re-acquire them for properties for which they would expire, we had reached 77.4% as of November 30, 2023.

Acquisition Coverage by Environmental Certifications

| Number of properties | Total floor area | Percentage of total floor area | ||

|---|---|---|---|---|

| DBJ Green Building |  |

2 | 24,876.30m2 | |

|

10 | 241,309.76m2 | ||

|

3 | 115,050.49m2 | ||

| Subtotal | 15 | 381,236.55m2 | 22.9% | |

| CASBEE for Real Estate |  |

17 | 248,929.93m2 | |

|

19 | 246,689.75m2 | ||

|

1 | 10,224.31m2 | ||

| Subtotal | 37 | 505,843.99m2 | 30.4% | |

| BELS |  |

9 | 82,038.12m2 | |

|

5 | 30,593.49m2 | ||

|

15 | 120,471.98m2 | ||

|

13 | 166,518.54m2 | ||

| Subtotal | 42 | 399,622.13m2 | 24% | |

| Environmental certifications | Total | 89 | 1,286,702.67m2 | 77.4% |

MRA will incorporate the measures for reducing climate-related risks recognized based on the scenario analysis in accordance with the TCFD’s recommendations into asset management of United Urban and link them to specific actions.

Moreover, we will promote constructive dialogue with stakeholders through information disclosure aligned with the TCFD’s framework and play a role in formulating and implementing climate change-related strategies of United Urban.